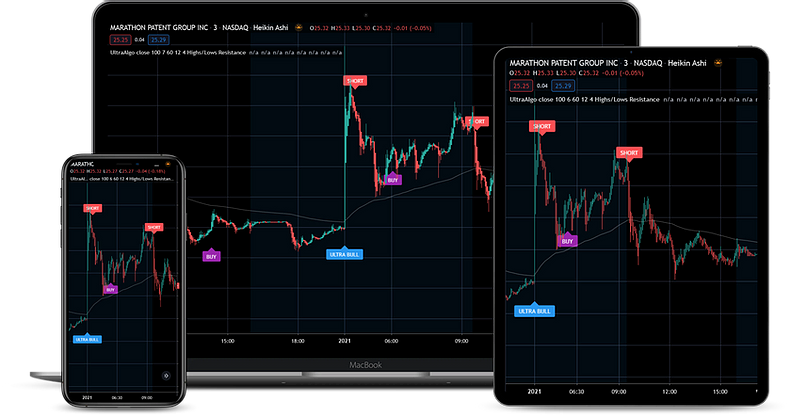

You’re privileged in order to begin in the futures marketplaces. This web site publish will talk about some of the best futures trading strategies for novices. We’ll center on why futures trading can be quite a amazing expenditure option and supply some canada futures trading easy methods to begin. Thus if you’re completely ready for further details on the marketplace of futures trading, make sure you keep reading!

Quite a few Upcoming Trading Methods Everyone Ought To Know

The futures trading markets can be quite a easy way to business, but it’s essential to use a strong comprehending of many tactics that can be found. Listed below are four well known futures trading strategies which every trader must know:

1.Buy and maintain: This is usually a relatively straightforward strategy concerning investing in a deal and keeping it until it finishes. This course is usually created consumption of by buyers who feel that the particular instrument price increases as time passes.

2.Offer and get once more: This strategy calls for giving a legal contract with a single cost and after that obtaining it back for less money. This may be obtained either well before or once the expiry day. This tactic is usually applied when a enterprise capitalist feels the underlying source of information worth will lessen at a later time.

3.Distribute trading: This plan entails promoting and purchasing two specific discounts concurrently. Distributes can be produced with any mix of futures commitments, and they’re often utilized to hedge against cost techniques or take advantage of arbitrage options.

4.Straddles and strangles: These are typically two associated tactics which include selling or buying a legal deal and after that offering or purchasing an additional commitment through a different expiry date. Straddles are being used every time a trader believes the exact advantage selling price will exchange sharply both in option. In comparison, strangles are used every time a endeavor capitalist thinks this charge will shift somewhat both in program.

Verdict

As you may have seen, there are numerous distinct futures trading methods that you can use. What one you select is dependent upon your expense wanted objectives and goals. Nevertheless, a large number of tactics could be used to earn money inside the futures marketplaces.